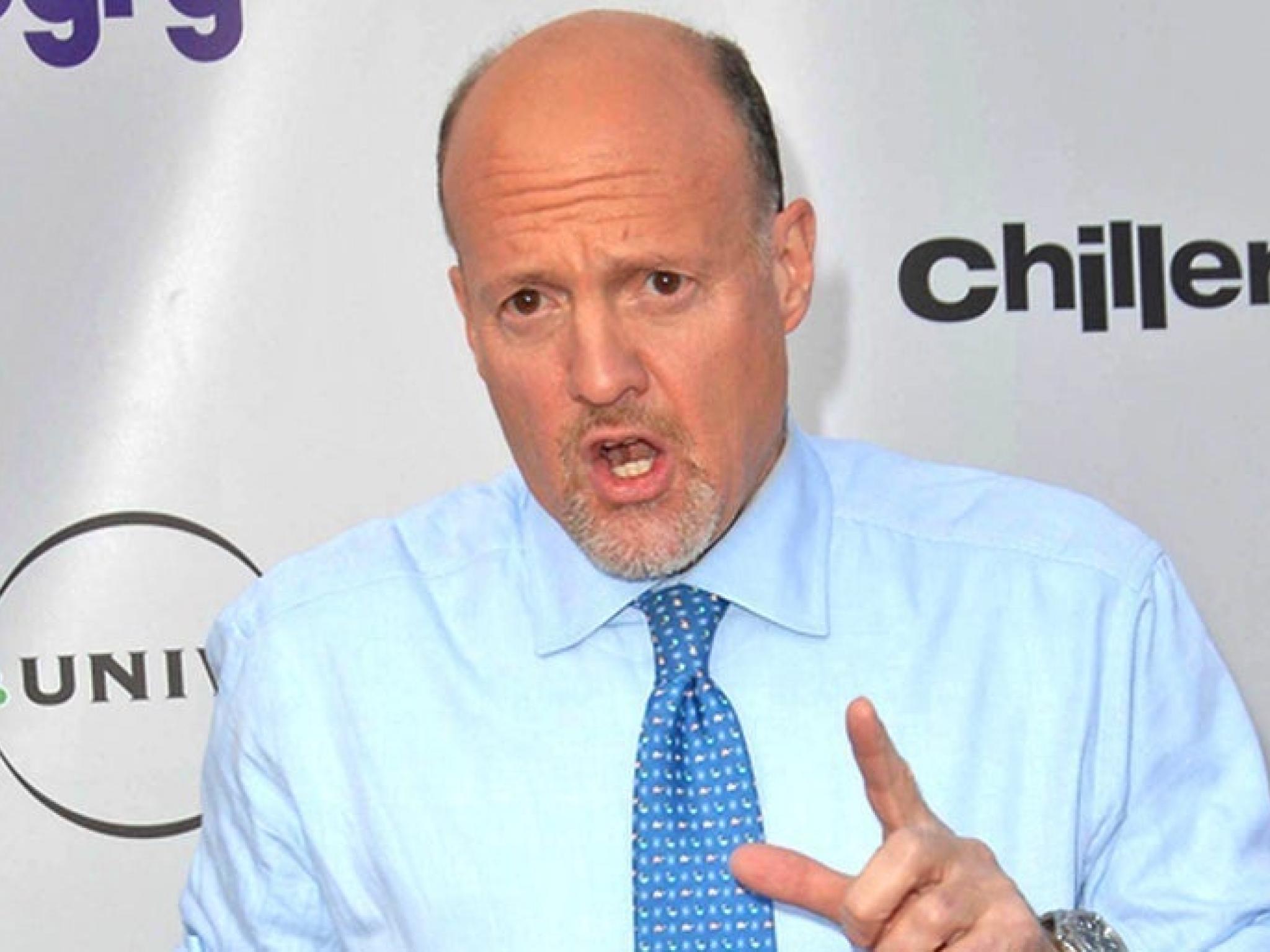

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said he likes Energy Transfer LP (NYSE:ET). The company will release earnings for the first quarter of 2025 on Tuesday, May 6, after the closing bell.

Cramer also said he likes Snowflake Inc. (NYSE:SNOW). “I’d pull the trigger.”

As per the recent news, Snowflake announced on Thursday that it received DOD IL5 Provisional Authorization on AWS GovCloud US-West. The authorization enables the company to offer solutions requiring the highest levels of protection for Controlled Unclassified Information.

The Mad Money host said this is a “fantastic chance” to buy Enterprise Products Partners L.P. (NYSE:EPD).

Supporting his view, JP Morgan analyst Jeremy Tonet maintained Enterprise Products Partners with an Overweight rating on March 27 and raised the price target from $37 to $38.

Cramer said no to Applied Digital Corporation (NASDAQ:APLD), adding that it is losing money.

On the earnings front, Applied Digital will host a conference call on Monday, April 14, to discuss its operations and financial results for the fiscal third quarter.

When asked about Peabody Energy Corporation (NYSE:BTU), Cramer said, “We got to be careful. It’s not going to make us money.”

Peabody Energy, on Feb. 6, reported mixed fourth-quarter financial results.

Price Action:

- Energy Transfer shares fell 4.6% to settle at $15.91 on Thursday.

- Snowflake shares declined 4.4% to close at $144.45 during the session.

- Enterprise Products Partners’ shares fell 2.5% to settle at $28.95.

- Peabody Energy shares dipped 8.4% to close at $11.23 on Thursday.

- Applied Digital shares dipped 7.1% to settle at $5.13 on Thursday.

Read Next:

Photo: Shutterstock